A Life of Relocating toAchieve Success

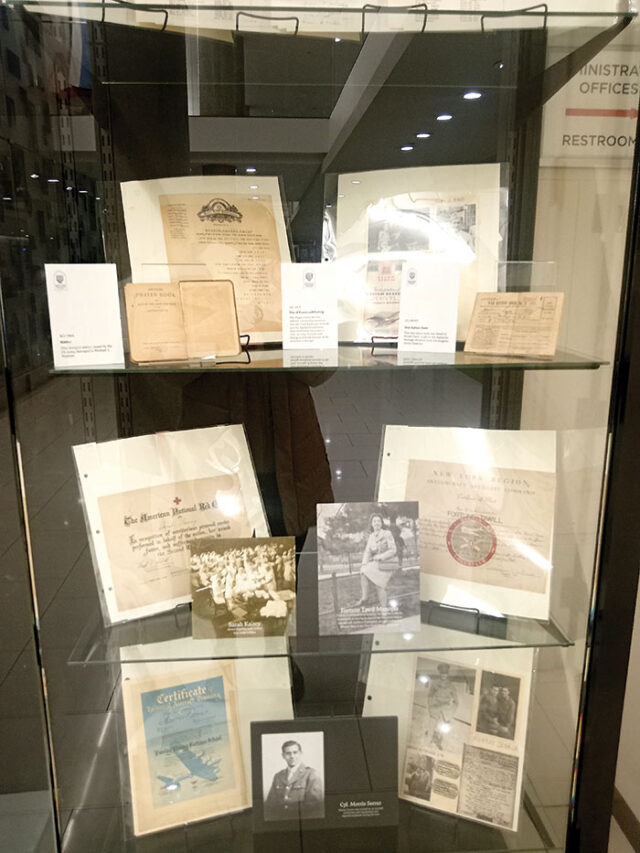

Bar mitzvah of Abraham Abadi with his grandfather Moises Abadi

From the Eretz Israel to Panama, Colombia, and Israel, then back to Colombia, onward to New York, Panama, Guatemala, and finally returning to New York

Sarina Roffé

The family life we have, our exposure to religion, the different cultural experiences of the places and countries where we lived, are what determines who we are today. Gladys Mandalaoui was born in Guatemala to Syrian parents. Her sister Fortuna Debbah and brothers Moises and Abraham were born in Panama. Her family history of living in different countries as well as the values taught by her traditional parents shaped the person she became, full of pride in her heritage.

The story began in or about 1913 when Abraham Zafrani, a young man born in Aleppo, left his family in Jerusalem. He was looking for a better life and to help his family survive. The Turkish government was conscripting young men and many young men left. He had a kitab (school) education and spoke Arabic.

Abraham traveled to Panama where he met his cousin and other friends. They were selling material to the workers of the Panama Canal. They organized the first Sephardic Synagogue in Panama.

In1923 Abraham met and married Alegre Zayat, who also had a Syrian background and had just arrived in Panama from Egypt. Their daughter Esther was born in 1924 in Panama. Six months later Abraham was offered a better business in Barranquilla, Colombia, so they moved. The business did well and the family was wealthy. They had four more children and sent their children to private secular schools.

They kept the Syrian Jewish traditions. Abraham taught his children Friday night prayers and helped build up the Sephardic synagogue there. He always yearned for his homeland and in 1935 he tried to relocate the family to Israel where the last child was born. They stayed in Eretz Israel a few months and there were rumors of another war. The Arab kids were using words that were offensive. Abraham was disappointed in life in Tel Aviv and decided to bring his family back to Barranquilla, Colombia.

In1940, Abraham sent his son Isaac Zafrani to a boarding school in New York. After seeing the Brooklyn community, he decided to move the family here. He also felt his daughters would meet and marry Syrian men, so they moved to Bensonhurst in Brooklyn, NY in 1942. But in 1944, many Syrian men were serving in the U.S. Army, defending our country during World War II. There were few candidates for Esther to marry. So, her father decided to take Esther to visit Panama, where she had been born. That’s where Esther met Leon Abadi, who was also born in Panama, and they married in October 1944, where she had Fortuna in 1945, Moises in 1947, and Abraham in 1950 in Panama. Gladys was born in Guatemala in 1955. They had a store called La Fortuna in Panama.

From Panama to Guatemala

Business in Panama was not so good. Leon’s brother-in-law offered him an opportunity to work in a rice plantation in a town in Guatemala. The idea seemed great, but neither of them knew anything about growing rice. Leon was supposed to be sending money to Esther, but the money wasn’t coming.

In 1952, Esther moved to Guatemala with the three children and settled there with her husband. Within a few years, it was clear that the rice business was not going to support them and they needed to look for another business.

Another of Leon’s sisters had moved to Guatemala and married. Her husband was a good businessman, and helped Leon identify a small store called El Panameño where he sold textiles. Esther was pregnant with Gladys, so they stayed in Guatemala. Other Jewish community members who owned factories produced fabrics that helped him. By 1957, his inventory was so large that he opened another store where Esther worked.

The family was successful in Guatemala and actively participated in the Jewish community and Magen David Synagogue. They were all well accepted by the community.

From 1952 until 1959, the family lived close to the Sephardic synagogue. Leon liked to go to synagogue on Friday nights and Saturday. The community had 500 families, about half of whom were Ashkenazic, and the rest were Sephardic. A few wealthy men supported the synagogue.

In 1959, the family bought a plot of land to build a home. Leon’s brother was an engineer in Panama. He designed the house using drawings sent by Leon that showed the position of the plot, the angles of the sun and other details. Leon was his own contractor. Overseeing the building of the house. Houses in Guatemala did not have basements but Leon insisted on a basement. Gladys and Fortuna shared a room, as did their brothers. It was a ranch style house with a large terrace on the roof.

The family had a housekeeper, gardener and a person who came weekly to do the wash, since they had no washing machine. They had a nice home with big gardens. They raised chickens and got eggs from the chickens. Esther cooked Syrian foods but also learned to make some local foods so the family learned to eat black beans and tortillas. Because Leon was Ambassador of Panama in Guatemala, they entertained often, and Esther served them.

There was one synagogue in the north and another in the south. The house was in the middle so they had to drive to synagogue. The rabbis lived in the synagogue and were all friends of the family. Leon helped the rabbis adjust to life in Guatemala. He helped with fundraising, and helped the synagogue run smoothly.

Kashrut was hard. “My grandfather was a shokhet and taught my father how to kill chickens. Most of time we ate chicken, killed by my parents, plucked and everything,” said Gladys. “Rabbi Moises Zaccai, came from Panama. He was trained at Mirrer Yeshiva and was a rabbi, shokhet and mohel. He killed the cows and chickens. We were among the most religious there. A lot were not religious. Still, Rabbi Zaccai would not eat in our house except for boiled eggs and fruit or uncooked vegetables. When rabbis came, they came to us.”

While Esther helped Leon in his business, she stayed home Sundays and cooked food for the week, always cooking the same Syrian foods that we eat today.

The family had two cars and often went for rides in the car. Esther drove and they shopped for food.

While there were no Jewish schools, the four children had good Jewish role models in their parents. The children attended private schools. Gladys attended an English American school. Fortuna attended a Catholic school. The school was strict and Fortuna had difficulty there. At age 12, for one year, she attended school in New York where she lived with her aunt. Then she returned to Guatemala and attended the Austrian school, where they taught her German. Tuition was about $15 a month.

Guatemala was a Catholic country. “No one understood why we wouldn’t pray the way they did. We had mass in school and when they said stand, we stood while the kids said Hail Mary,” said Gladys, “We were respectful and didn’t talk when they prayed. We knew it was their religion. We never kneeled. Nothing happened to us, we respected them and they left us alone.

“I never had a play date with them. We knew those are people from the country and we knew we were different. We only associated with them when we had to. We didn’t mix with them or mingle. We never invited them to our home. The school had a boys and girls section. At the end of the year, when we celebrated Guatemalan Independence Day, the school brought the boys and girls together to practice for a parade. That’s the only time we saw them. They were not Jewish, so my parents would not allow us to mingle with them either.”

Gladys remembers having many Jewish friends. They used to socialize at a Jewish club on Saturday afternoons, where they learned Zionism, Jewish culture, Israeli songs and dances.

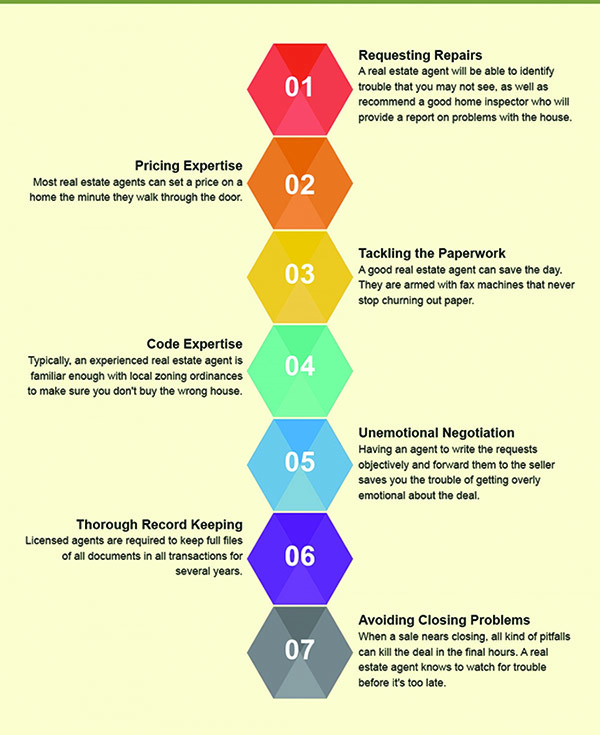

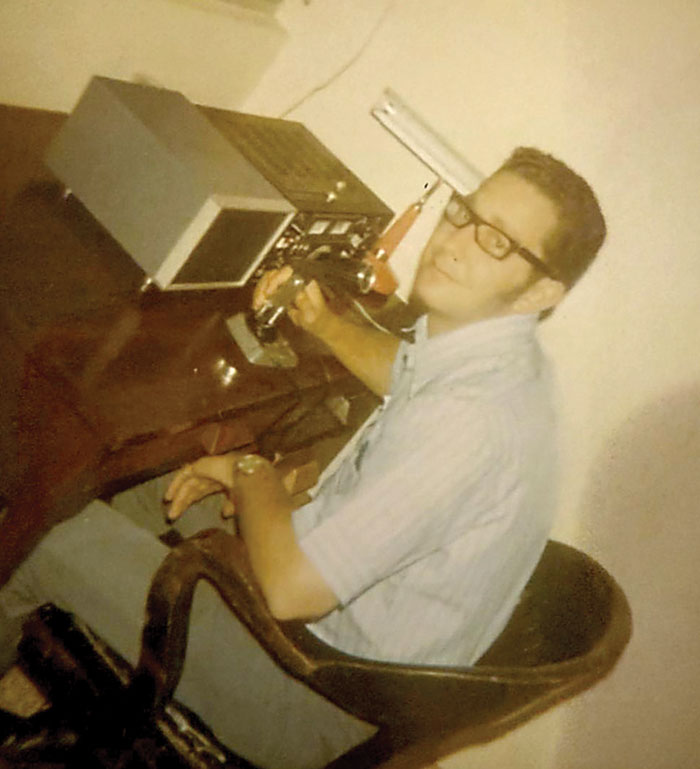

Some people had summer homes, where the Abadi children would visit. For fun, they went to fairs, the movies, picnics at a nearby lake, or visited farms. Leon liked the latest equipment. They had a color TV and he was a ham radio operator in Guatemala using the handle TG9AE. Often Israelis would come to try and convince them to make Aliyah to Israel, plant trees and sell Israel bonds.

In 1964, the Abadis sent Fortuna to Brooklyn as she was of marrying age. In 1965 she married Jaime Debbah, where she settled and raised her family.

By 1972, many were leaving Guatemala because they wanted a better education for their children so went to the United States. There was also the issue of safety as there were kidnappings and people couldn’t go out at night. As a diplomat, Leon had many parties at his home.

A few families made Aliyah to Israel. In 1972, Leon was appointed as a Delegate of Panama to the United Nations and he moved the family to Brooklyn. Gladys attended and graduated from Lincoln High School in 1972.

Both Moises and Abraham went to Panama and married women from Barranquilla. Moises married Rina Gateno in 1980. Abraham married Miriam Birbragher in 1981. Abraham worked in the consulate of Panama in New York when he married Miriam. Then he became Vice Counsel of Panama in Bogota.

Gladys met Sol Mandalaoui, who was born in 1950 in Egypt and came to New York in 1962. They were married in January 1975 and had three children – Ikey, David and Paulette–and they all married in the community. Gladys and Sol have ten grandchildren ranging from ages 23 to 10 years old.

Leon passed away in 1990 and Esther passed away in November 2024 at the age of 100. Baruch dayan emet (blessed is the judge of truth). q

A genealogist and historian, Sarina Roffé is the author of Branching Out from Sepharad (Sephardic Heritage Project, 2017). She is researching a new book: Syria – Paths to Freedom. Sarina holds a BA in Journalism, and MA in Jewish Studies and an MBA.