A CLEAR GUIDE TO YOUR OPTIONS, INCLUDING HOW TO AVOID A SURPRISE TAX BILL OR IRS PENALTIES

ARI BAUM, CFP®

WHEN YOU LEAVE AN EMPLOYER (WHETHER YOU’RE CHANGING JOBS OR RETIRING), YOUR RETIREMENT PLAN DOESN’T AUTOMATICALLY MOVE WITH YOU. YOU HAVE TO MAKE A CRITICAL DECISION (OR RISK HAVING THAT DECISION MADE FOR YOU IN A WAY THAT’S BETTER FOR THE COMPANY OR COSTS YOU MONEY).

Your employer plan is one of your most valuable retirement assets and deciding where it should go next is a decision with plenty of nuances, pitfalls, and opportunities. Handle it the right way, and you’ve protected your money’s tax-deferred growth and are in an optimal position for your current and future goals. Handle it the wrong way, and you’ve given yourself a surprise tax bill, exposed yourself to potential IRS penalties, or robbed yourself of potential future wealth.

If you fall into any of these categories:

• I left my old company and I need to figure out what to do with my old plan.

• I’ve got “zombie” plans sitting around and I’ve got questions about what I should do with them.

• I’m at or nearing retirement and I need to figure out how to turn my retirement plan into income.

You’re in the right place. After you’ve read this guide, you’ll have all the information you need to decide which strategy makes the most sense for your old retirement plan and know how to take the next steps that are right for you.

If you’re at or approaching retirement age, you’ve got more to consider than just where to move your old plan. You’ll need to decide where your income is coming from, choose when to claim Social Security and Medicare, determine the right order to draw down your accounts, and much more.

OPTION 1: DON’T TOUCH A THING

If your employer’s plan allows it, you may be able to leave your account where it is, though you won’t be able to continue making contributions to it. However, you’ll be stuck dealing with whatever limited service is offered to ex-employees.

PROS

• If you retire after age 55, you may not owe a 10% tax penalty on withdrawals.

• If you own considerable company stock, you might qualify for a favorable tax break (called Net Unrealized Appreciation).

• You may have access to plan loans. You may qualify for federal creditor protection.

CONS

• You may end up with a trail of old accounts gathering dust.

• Not all employers will allow you to leave your plan. (It may depend on the size of the balance.)

• Plan fees may increase without your knowledge.

• You may have limited withdrawal options.

• Investment options are limited to the standard options currently offered to employees.

• Your investments may not be optimized for taxes or your overall financial goals.

How to Execute: Contact your previous plan administrator and ask to leave the plan in place.

OPTION 2: MOVE IT TO YOUR NEW EMPLOYER

If you’re still working, a new employer might allow you to simply transfer your old account balance to the plan they offer their employees. Not all employers allow you to do it, but it’s worth asking about.

PROS

• You’ll have your employer plans in one place.

• You won’t pay taxes on the distribution if you transfer directly.

• You’ll have the protections and benefits of the current plan.

CONS

• Your new employer may not allow you to transfer your old account.

• You’ll be limited to the investment options offered by the new plan.

• Many employers will require you to wait to become eligible to enroll in the new plan.

How to Execute: Contact the HR department at your new employer and ask them to put you in touch with the plan administrator. If the transfer is possible, they’ll give you instructions on how to complete the move.

OPTION 3: RAID THE PIGGY BANK (CASH IT OUT)

You have the right to cash out your old employer plan and take a check. This is probably your worst move because the financial repercussions are serious (and permanent).

PROS

• You’ll get immediate cash.

CONS

• You’ll owe income taxes on the account value.

• Your employer may automatically withhold 20% for taxes.

• You’ll owe penalties if you’re under age 59½ (unless you qualify for an exemption).

• You’ll do permanent damage to your long-term goals.

How to Execute: Contact your previous plan administrator and ask him to liquidate the account and send you a check.

OPTION 4: THE NOT-SO-SIMPLE INDIRECT IRA ROLLOVER

Indirect IRA Rollover

You have the option to take a check from your old plan and roll it over into an IRA within 60 days. Some people like the idea of having a free 60 day loan, but indirect rollovers are fraught with potential (and expensive) mistakes.

PROS

• You’ll get immediate access to the cash for 60 days.

• When the rollover is completed, you’ll get the benefits of an IRA, including access to many investment options, tax optimization strategies (including Roth conversions, backdoor Roth IRAs, etc.), and investment optimization for your overall financial picture.

CONS

• You have to manually take the check and remember to deposit it into your IRA.

• Indirect rollovers get reported to the IRS.

• If you fail to roll the funds over within 60 days, you may owe taxes and potential penalties.

• You risk making your retirement funds fully taxable forever.

•You risk losing out on any market gains that happen within your rollover window.

• Your employer may automatically withhold 20% for taxes (and you’ll have to make up the amount from other funds).

•Your new IRA might have higher fees than the old plan.

• While you may be allowed to take penalty-free withdrawals from an employer plan after age 55, you typically can’t withdraw penalty-free from an IRA until age 59½.

• Typically, assets in an employer retirement plan have greater protection from creditors than assets held in an IRA.

• Once you reach age 72, you’ll need to take Required Minimum Distributions (RMDs) from both employer plans and IRAs. However, if you continue to work past age 72, you generally aren’t required to take RMDs from your current employer’s plan.

How to Execute: Contact your previous plan administrator and ask him to liquidate the account and send you a check. You’ll have to send the check to your new IRA custodian (and have it deposited) within 60 days, unless you qualify for a limited exemption to the 60 day rule.

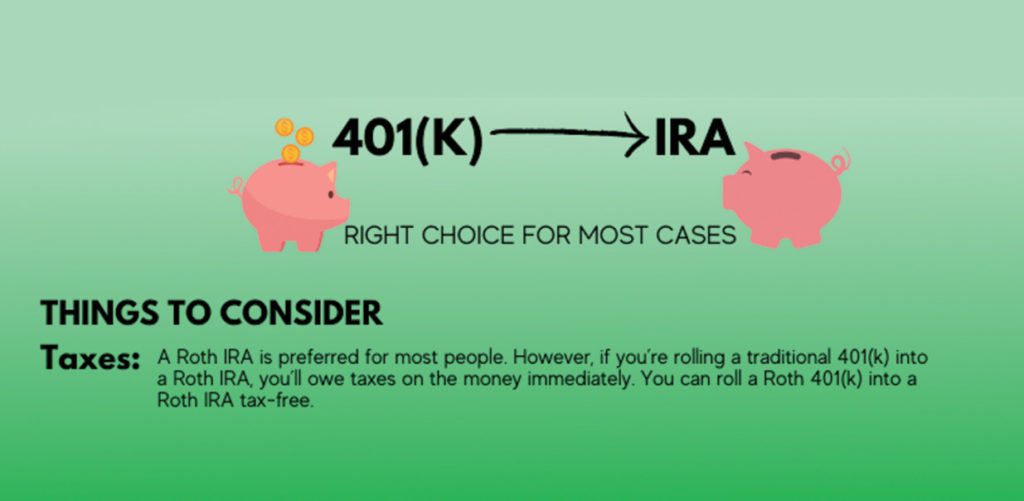

OPTION 5: DIRECT ROLLOVER TO AN IRA

Directly rolling over your account assets to an IRA is a seamless process that avoids all the limits placed on rollovers by the IRS. It gives you all the benefits of your own, personalized IRA without the pitfalls of an indirect rollover.

PROS

You’ll get the benefits of an IRA, including:

• Access to many investment options

• Tax optimization strategies (including Roth conversions, backdoor Roth IRAs, etc.)

• Investment optimization for your overall financial picture.

• You’ll avoid all potential IRS penalties by never taking “custody” of the money.

• You won’t owe taxes on the transfer.

• Your employer won’t withhold any amount from the balance for taxes.

CONS

• You’ll have to do some paperwork.

• Your new IRA might have higher fees than the old plan.

• While you may be allowed to take penalty-free withdrawals from an employer plan after age 55, you typically can’t withdraw penalty-free from an IRA until age 59½.

• Typically, assets in an employer retirement plan have greater protection from creditors than assets held in an IRA.

• Once you reach age 72, you’ll need to take Required Minimum Distributions (RMDs) from both employer plans and IRAs. However, if you continue to work past age 72, you generally aren’t required to take RMDs from your current employer’s plan.

How to Execute: Contact your previous plan administrator and ask him for a “direct rollover” to your IRA. He’ll give you the next steps you need to take.

How to Execute: Contact your previous plan administrator and ask him for a “direct rollover” to your IRA. He’ll give you the next steps you need to take.

The #1 mistake I see people make with their most important retirement asset—doing nothing at all.

Mistakes with old employer plans are common and can be very costly. They are also easily avoidable if you know exactly what to do. If you’re not 100% confident in your next steps, you don’t need to go it alone, contact a financial professional.

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Ari Baum, CFP® is the founder and CEO of Endurance Wealth Partners, with over 25 years experience in the Financial Services industry. He brings his in-depth experience to Conceive. Believe. Achieve. for his clients.

Brokerage and Advisory accounts carried by Wells Fargo Clearing Services, LLC. Securities and Advisory services offered through Prospera Financial Services Inc. Member FINRA/SIPC.