Vanguard’s S&P 500 ETF (VOO) has officially dethroned State Street’s SPDR S&P 500 ETF (SPY) as the world’s largest exchange-traded fund (ETF) by assets under management. This marks a major shift in the investment landscape, as SPY had dominated the market for over three decades.

VOO Takes the Lead

As of February 2025, VOO holds $632 billion in assets, edging out SPY, which now sits at $630 billion. The change in rankings is fueled by a massive $21.3 billion in inflows into VOO in January alone, accounting for 12.9% of all U.S. equity ETF inflows. Meanwhile, SPY experienced a sharp $19.4 billion in outflows, representing 25.7% of total U.S. equity ETF outflows.

Why Is VOO Winning?

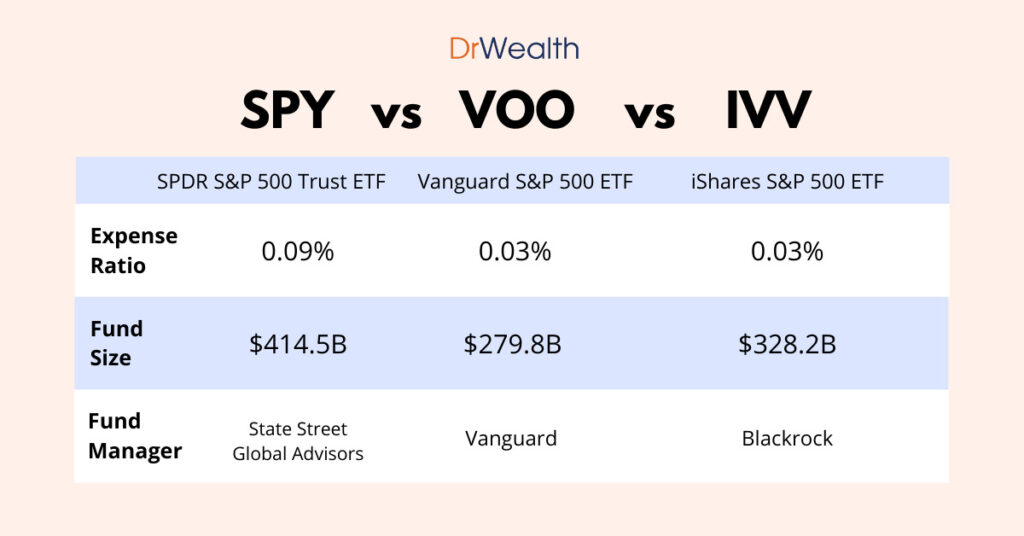

One of the key reasons for VOO’s rise is its ultra-low expense ratio of 0.03%, significantly lower than SPY’s 0.0945%. Vanguard’s reputation for cost efficiency and long-term investing has attracted investors looking for lower fees and better compounding returns over time.

Another factor is the growing shift away from actively traded funds like SPY, which is often used for short-term trading. VOO, on the other hand, appeals to long-term investors seeking broad market exposure with minimal costs.

A Three-Way Race?

While VOO now leads, BlackRock’s iShares Core S&P 500 ETF (IVV) remains a formidable competitor, holding $609 billion in assets. IVV also offers the same low 0.03% expense ratio as VOO, making it a strong alternative for cost-conscious investors.

The Future of ETFs

The battle for ETF supremacy underscores a larger trend: investors are increasingly prioritizing low costs and long-term growth. Vanguard’s triumph signals a potential shift in ETF dominance, and it remains to be seen whether SPY can reclaim its top spot or if IVV will close the gap.

As competition in the ETF space intensifies, investors stand to benefit from lower fees and better investment options in the years ahead. 🚀📈

Sources: FinancialTimes, Reuters, Finimize, MarketWatch, ETFTrends.