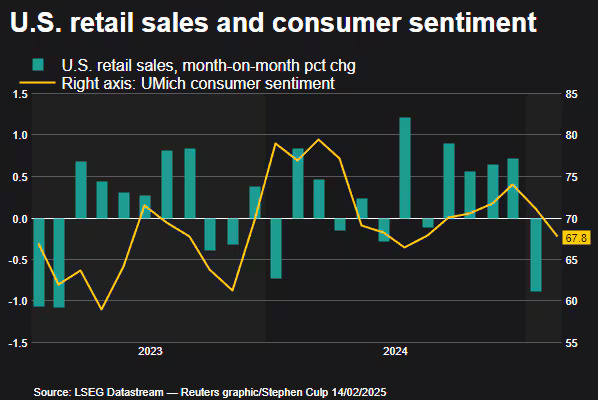

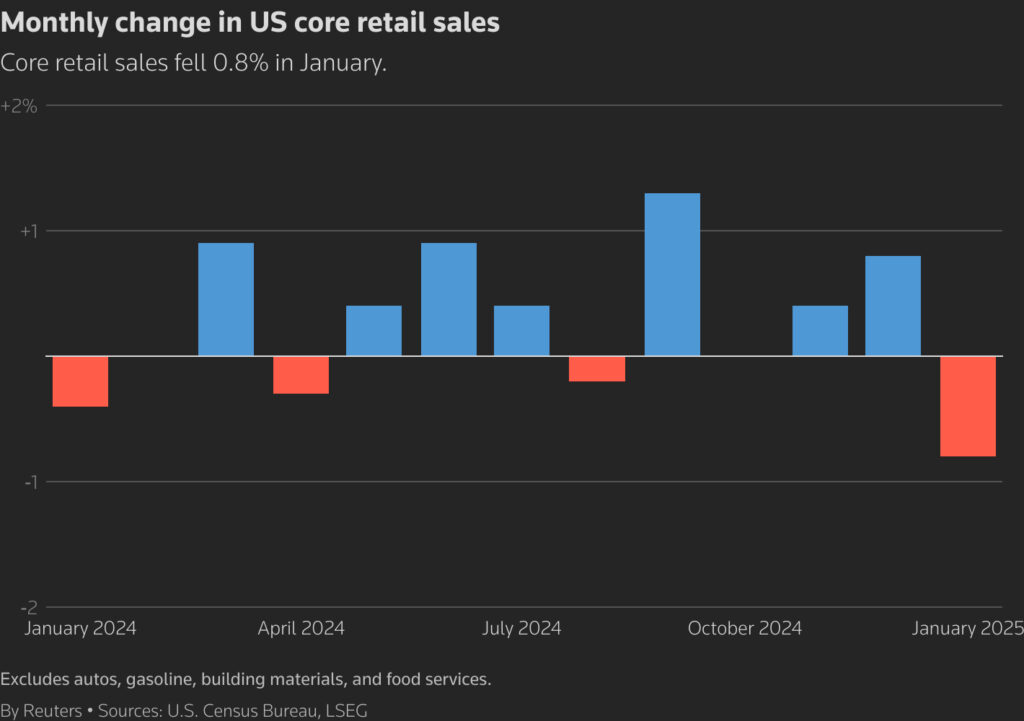

U.S. retail sales experienced their largest drop in nearly two years this January, impacted by extreme winter weather, wildfires, and vehicle shortages. According to the Commerce Department, sales fell by 0.9%, a significant decline following a 0.7% increase in December. Despite this setback, economists believe this dip does not signal a long-term shift in consumer behavior but rather reflects seasonal volatility.

Factors Behind the Decline

1. Harsh Weather Conditions: Severe snowstorms and freezing temperatures across the U.S. significantly limited shopping activity, while wildfires in Los Angeles disrupted commerce in one of the nation’s largest metro areas.

2. Motor Vehicle Shortages: Auto sales saw a steep drop of 2.8%, partially due to weather-related showroom closures and low inventory levels.

3. Consumer Sentiment and Tariffs: Economic uncertainty, including confusion over new tariffs on Mexican, Canadian, and Chinese imports, may have contributed to lower consumer spending.

Broader Economic Impact

While retail sales fell, certain sectors showed resilience. Food services and drinking establishments recorded a 0.9% increase, indicating that consumer discretionary spending remains steady in some areas. However, significant declines in online retail (-1.9%), sporting goods (-4.6%), and furniture and clothing sales suggest that consumers exercised caution in their spending.

Economists continue to predict that the Federal Reserve will not adjust interest rates until the latter half of the year, with inflation concerns and previous aggressive rate hikes keeping monetary policy steady. The Federal Reserve has already raised rates significantly in 2022 and 2023 to combat inflation, and it left them unchanged in January at a range of 4.25%-4.50%.

What Lies Ahead?

Despite the retail sales slump, labor market stability and high household wealth continue to provide underlying economic strength. The Atlanta Fed has adjusted its first-quarter GDP growth estimate down to 2.3% from a previous 2.9% forecast, reflecting the impact of weaker retail performance.

Tuan Nguyen, a U.S. economist at RSM US, noted that the economy’s underlying strength remains intact. “If that strength persists, we should expect sales to rebound in the coming months.”

Conclusion

While January’s sharp retail sales drop raises concerns, economists remain cautiously optimistic that this is a temporary downturn driven by external factors such as severe weather and supply chain constraints. With consumer spending showing resilience in select areas, the coming months will be key in determining whether this trend is a momentary blip or the start of a more cautious spending pattern.

Sources: Reuters, ForexLive, APNews, CNBC, FN, Bloomberg