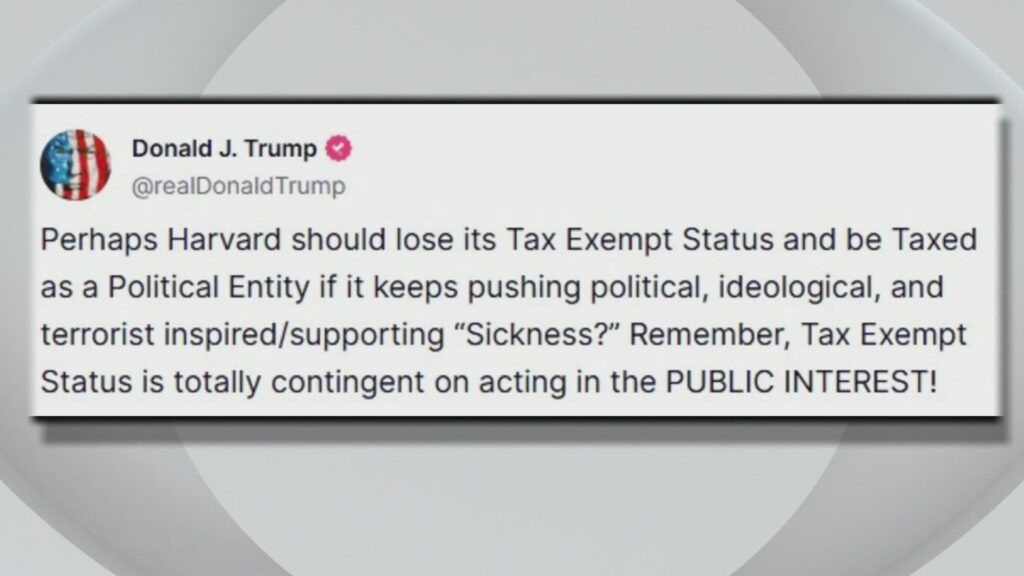

In a dramatic escalation of tensions between the Trump administration and one of America’s most prestigious universities, the IRS has been directed to review — and potentially revoke — Harvard University’s tax-exempt status. The move, led by the administration, comes amid allegations that Harvard has been promoting political ideologies in violation of its nonprofit charter.

A Political and Financial Power Play

At the heart of the controversy is Harvard’s classification as a 501(c)(3) nonprofit organization. Under this status, the university enjoys exemption from federal income taxes and offers tax-deductible benefits to its donors. However, under federal law, institutions with this designation must avoid overt political activity or lobbying efforts that favor a particular party or candidate.

According to administration officials, Harvard has crossed the line. “Taxpayer-funded privilege should not be used to promote partisan ideology,” a senior Trump administration source stated. “No university is above the law, no matter how elite.”

The Trigger: Refusal to Share Admissions Data

The battle was sparked, in part, by Harvard’s recent refusal to comply with federal requests for detailed admissions data, including metrics related to race, legacy admissions, and financial backgrounds. Critics argue the university’s opaque practices conflict with transparency standards expected of tax-privileged institutions.

This defiance, paired with increasing scrutiny over elite colleges’ ideological leanings, has fueled the administration’s argument that Harvard is engaging in political behavior, particularly in light of campus events and faculty statements that have been openly critical of conservative policies.

Billions at Stake

The financial consequences for Harvard could be historic. The university’s $52 billion endowment — the largest of any educational institution in the world — could become subject to taxation if its 501(c)(3) status is revoked. Additionally, its extensive real estate holdings in Cambridge and beyond could also lose property tax exemptions, potentially leading to tens or even hundreds of millions in annual tax liabilities.

As part of the administration’s initial actions, a staggering $2.26 billion in federal research funding allocated to Harvard has already been cut — a clear warning that more punitive measures may follow.

Harvard Responds

In a statement released late Monday, Harvard University expressed “deep concern” over the administration’s actions, calling them “a dangerous overreach and an attack on academic freedom.”

“Harvard has always upheld a rigorous standard of academic independence,” the statement read. “We strongly reject the implication that our teaching, research, or community engagement violates our tax-exempt obligations. This investigation is politically motivated and threatens institutions across the nation.”

Legal Battle Looms

Legal experts predict the issue could become a landmark case on the intersection of education, politics, and tax law. While the IRS has the authority to revoke tax-exempt status, it rarely does so for institutions of this scale and prominence.

Critics of the move argue it sets a dangerous precedent, where universities could face federal retaliation for dissenting viewpoints. Supporters counter that accountability is long overdue for elite institutions they say have become “ideological echo chambers.”

What Happens Next?

Harvard has vowed to challenge any IRS action in court, and legal proceedings could stretch over years. In the meantime, the outcome of the 2024 presidential election may play a decisive role in determining how aggressively the revocation is pursued or reversed.

Regardless of the outcome, the confrontation has already shaken the foundations of higher education’s relationship with the federal government — and raised urgent questions about the future of academic freedom, institutional transparency, and political neutrality.

Sources: WallStreetJournal, NYTimes, AXIOS, Bloomberg, Forbes.