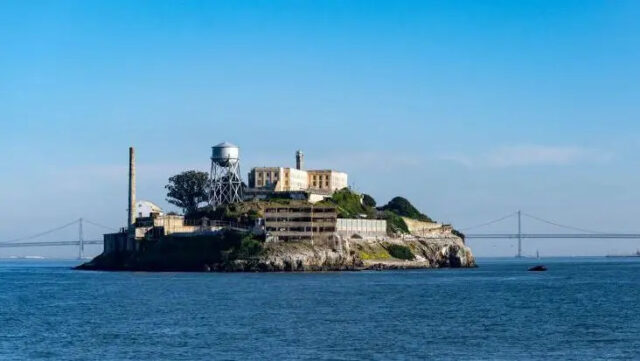

Jerusalem and the Power of Faith

Rabbi Lord Jonathan Sacks ZT”L

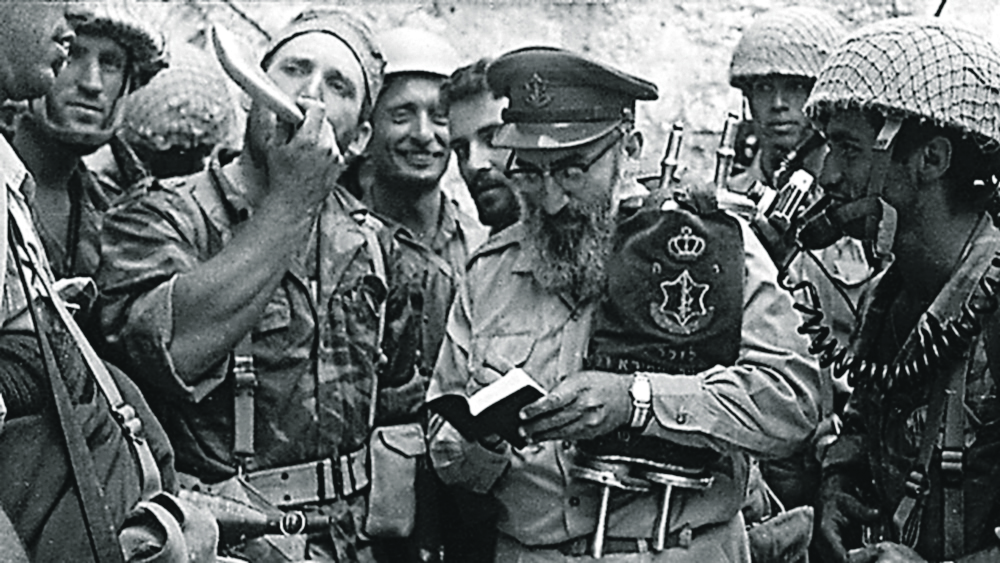

There are times when you know you are living through history: that what you are witnessing will be remembered for centuries. That is what I, and surely every Jew, felt on the day when the word went round the world: Har haBayit beyadenu, “The Temple Mount is in our hands.” That day, 28 Iyar, the Chief Rabbi of the Israel Defense Forces, Rabbi Shlomo Goren, carried a Sefer Torah to the Kotel, blew the shofar, and recited Psalms.

Yitzhak Rabin, Chief of Staff at the time, described the scene: “We stood among a tangle of battle-weary men who were unable to believe their eyes or restrain their emotions. Their eyes were moist with tears, their speech incoherent. The overwhelming desire was to cling to the Wall, to hold on to that great moment as long as possible.”

When the Israelis reached the Jewish Quarter, they discovered that it had been reduced to rubble. Synagogues had been destroyed and holy places desecrated. Moshe Dayan made an immediate public announcement that Israel would act differently: “To our Christian and Muslim fellow citizens, we solemnly promise full religious freedom and rights. We did not come to Jerusalem for the sake of other peoples’ holy places and not to interfere with the adherents of other faiths, but in order to safeguard its entirety.” Israel has kept that promised since.

No people has ever loved a city as, for 3,000 years, Jews have loved Jerusalem. The Book of Psalms calls it “beautiful in its heights, joy of all the earth, city of the great King.” The word ‘Jerusalem’ appears almost 700 times in Tanach. There are few laments that speak to us with such undiminished force as the words Jews said, twenty-six centuries ago, when Jerusalem was conquered by the Babylonians: “If I forget you, Jerusalem, may my right hand forget its skill. May my tongue cling to the roof of my mouth if I do not remember you, if I do not consider Jerusalem my highest joy.”

Wherever Jews prayed, they prayed towards Jerusalem. At every wedding they broke a glass in its memory. At the two great climaxes of the Jewish year, on Pesach and at the end of Yom Kippur, they sang, L’shanah haba’ah biYerushalayim.

It is said that once Napoleon was passing a synagogue and heard sounds of lamentation. “Why are the Jews crying”, he asked. “They are mourning the loss of Jerusalem”, one of his officers replied. “How long ago was that?” he asked. “More than seventeen centuries ago,” the officer replied.

“A people that can mourn the loss of Jerusalem for so long, will one day have it restored to them”, Napoleon said. And so it was.

It is worth remembering that on the first day of the war, 5 June 1967, Israel sent three messages to King Hussein of Jordan – one through the United Nations representative, another via the American ambassador and a third directly. Israel would not attack Jordan if Jordan did not enter the war. Israel would “honor the armistice agreement with Jordan in its entirety.” The West Bank, East Jerusalem, and the Old City, would remain under Jordanian control. There was no reply. Instead, Jordan attacked. Had King Hussein not hardened his heart, Jerusalem would still be in Arab hands. It is one of the great ironies of history.

I remember the first time I looked down on the Old City and the Temple Mount. I was standing on Mount Scopus, the original and now rebuilt site of the Hebrew University. I recalled the moment described in the Talmud when Rabbi Akiva and his colleagues stood on the same spot, looking down at the ruins of the Temple. The Rabbis wept. Rabbi Akiva smiled.

“How can you smile?”, they asked. “The place that was once the most sacred spot on earth is now laid waste and a fox is walking across the Holy of Holies where once only the High Priest was allowed to enter, and only on the holiest of days.”

“I smile”, Rabbi Akiva replied, “because the prophets prophesied that Jerusalem would be laid waste, and they prophesied that it would be rebuilt. Now that the one prophesy has been fulfilled, can we doubt that the other will be likewise?”

That was when I realized the power of faith. Jews never lost faith that one day they would return. And they did. It was faith that brought the Jewish people back to Israel and rebuilt the ruins of Jerusalem.

So, as we remember those events, let us thank G-d for the freedom to stand once again in David’s city, joining our prayers to those of our ancestors in the place the Divine Presence never left and to which the Jewish people has now returned.