ARI BAUM ®

$100 IS ON THE TABLE, AND YOU ARE GIVEN A CHOICE. YOU CAN EITHER OPT TO RECEIVE A GUARANTEED $50 OR TAKE A RISK BY FLIPPING A COIN. IF THE COIN LANDS ON HEADS, YOU GAIN $100, BUT IF IT LANDS ON TAILS, YOU RECEIVE NOTHING. GIVEN THIS CHOICE, MOST INDIVIDUALS WOULD LIKELY CHOOSE THE ASSURED $50. HOW ABOUT YOU?

Now, consider a scenario where the focus shifts to potential losses. Imagine you are at risk of losing $50 right from the start. Furthermore, envision that in the coin toss, landing heads would result in a loss of $100, while landing tails would mean no loss at all. Here, most folks choose to flip the coin. What would you do?

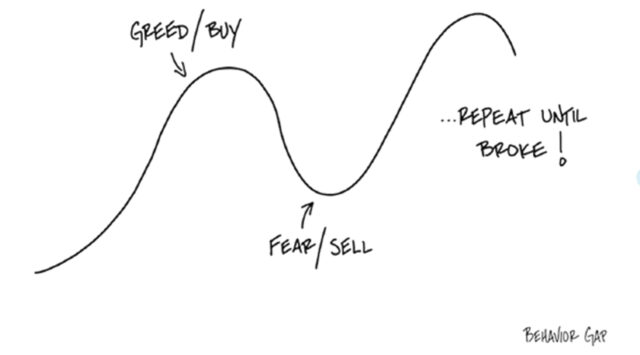

In the realm of financial choices, fear and greed often play pivotal roles, influencing decisions that may not be in one’s best interest. The inherent fear of losses and the allure of gains can lead individuals to make emotional decisions that disrupt our ability to make sound, long-term decisions.

How $25 Trillion+ Has Been Lost

To Greed & Fear In 35 Years

1987 Stock Market Crash (Black Monday)

When: Monday, October 19, 1987

Why: Panic! Wall Street melted down, giving into fear in response to major world events. A U.S. attack on an Iranian oil platform caused a massive panic, with fear driving many to sell ASAP. Markets crashed soon after.

The Losses: The Dow dropped 22.6%, falling 508 points. That’s roughly the same as a 7,000-point freefall in today’s markets.

Dotcom Bubble

When: 1995 to 2002, with a peak on March 10, 2000, and a crash on October 4, 2002

Why: Extreme optimism in the early internet age sparked overconfidence, widespread speculation, and overvaluations. Folks gave into greed, rushing to invest in companies and concepts before they had proven models or even a business plan. That lasted for years until the bubble burst in late 2002, as investment dollars dried up and many tech companies went under. When the bubble burst, greed turned into FEAR as investors rushed to get out.

The Losses: The Nasdaq fell nearly 77%, dropping from roughly 5,132.52 (in March 2000) to 1,139.90 by October 2002. Tech companies that didn’t go under saw their values decline by as much as 80%. All said and done, the burst of the dotcom bubble resulted in losses of around $5 trillion.

Cryptocurrency Bubble & Bust

When: 2020 to 2022

Why: Crypto has been through a couple of bubbles and busts. The most recent one happened during the pandemic, with greed gripping many folks out of work and bored at home. That’s when optimism and crypto greed was high, with many rushing to buy the newest blockchain assets available, including nonfungible tokens (NFTs). Some of these assets appreciated by 20 to 40 times their original value, stoking investor greed. But it didn’t last. Rising interest rates, inflation, and world events, like the war in Ukraine, soon turned that greed into fear. That fear led to a crypto crash in late 2022, with incredible losses to follow.

The Losses: An estimated $2 trillion was lost so far in the most recent crypto crash. Most of that disappeared in about 6 months.

What if you ignored the cycle of fear and greed?

The Lump Sum Investment

Let’s look at a simple example: Someone invests a lump sum of $100,000 in the S&P 500 in January 1987. Assuming an average annual return of 10.11% over the next 35 years, that 100k would have grown to about $3,206,940 by the end of 2022.

Takeaway: This shows the significant compound growth possible from a lump sum investment left untouched for decades. Of course, staying invested through many ups and downs requires patience and discipline. But the long-term rewards can be substantial with a buy-and-hold approach.

The Power of Consistency

Consider the following investment approach: Investing $500 per month in the S&P 500 from 1987 through 2022.

That’s a total investment of $210,000 over 35 years. Assuming an average annual return of 10.11%, those monthly $500 contributions would have grown to around $1.7 million by the end of 2022.

Takeaway: This example illustrates the power of consistent investing over long time periods. By sticking to a regular contribution plan, one can potentially build substantial wealth through compounding growth, even if investing relatively small amounts. The key is to stay disciplined and keep investing through ups and downs.

FINANCIAL LESSON

Were you surprised to see the losses caused by greed and fear?

If you could go back in time and handle any of them differently, would you?

No one can predict what’s going to happen next, and that can be a tipping point for fear and greed, especially in turbulent times. With that fear and greed, we tend to be more impulsive. We may even panic and rush to act because we’re afraid of missing out (FOMO, anyone?). That’s when we can be more vulnerable to poor choices and the losses that we’re so desperate to avoid, like selling low and buying high. The more we know about fear, greed, loss, and our financial choices, the better. That’s how we can get our emotions and instincts in check to make better financial decisions, regardless of what the markets are doing. Of course, that’s not always easy to remember in the moment. That’s why we shouldn’t jump on any bandwagons or dive into big financial choices without thinking them through.

Instead, we can take some simple steps to avoid the fear/greed cycle and do the following:

- Set some long-term financial goals.

- Get some distance and avoid checking your portfolio day to day.

- Take your time and think things through.

It’s prudent to check in with the folks you trust, especially when it’s time to make major money moves.

Risk Disclosure: Investing involves risk including the potential loss of principal. Past performance does not guarantee future results. This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information. Consult your financial professional before making any investment decision. For illustrative use only.

Ari Baum, CFP® is the founder and CEO of Endurance Wealth Partners, with over 26 years of experience in the Financial Services industry. He brings his in-depth experience to Conceive. Believe. Achieve. for his clients.

Securities and Advisory services offered through Prospera Financial Services Inc. Member FINRA/SIPC. Brokerage and Advisory accounts carried by Wells Fargo Clearing Services, LLC.