Global markets and economic analysts are sounding alarms as U.S.-China trade tensions enter a volatile new phase. President Donald Trump has issued a bold new threat: a 50% tariff on all Chinese imports, significantly intensifying the ongoing trade dispute between the world’s two largest economies. In response, China has vowed to “fight to the end,” pledging firm retaliation and stoking fears of a protracted economic cold war.

A Growing Economic Firestorm

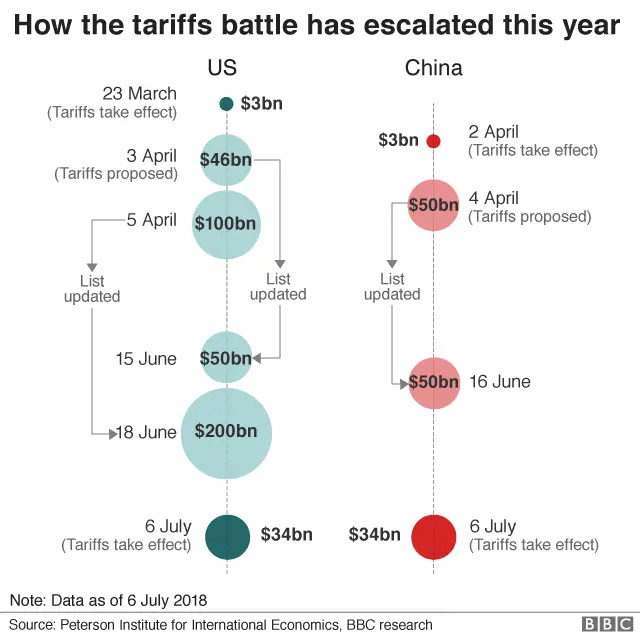

The latest exchange comes amid escalating protectionist rhetoric and punitive economic policies on both sides. China had already responded with a 34% retaliatory tariff on U.S. goods. Now, with Trump’s new threat, combined U.S. tariffs on Chinese imports total a staggering 104%, according to trade analysts—raising alarm over the inflationary effects on U.S. consumers, particularly in key sectors such as electronics, clothing, and home goods.

These tariffs have the potential to reverberate throughout global supply chains, as multinational corporations re-evaluate production hubs and pricing strategies amid the geopolitical uncertainty.

The Numbers Behind the Battle

In 2024, U.S.-China trade reached $582 billion, a slight rebound from pandemic-era lows, but the U.S. trade deficit with China still stood between $263–$295 billion. Trump has repeatedly cited this deficit as justification for the tariffs, claiming that tougher trade terms are essential to protect American manufacturing and jobs.

China, meanwhile, has been subtly responding through monetary policy. The Chinese central bank allowed the yuan to weaken past 7.20 per U.S. dollar, officially setting the reference rate at 7.2038, the weakest point since September 2023. A weaker yuan could help offset some of the tariff impacts by making Chinese exports cheaper—but it also risks capital flight and further currency volatility.

Trump’s Hardline Global Strategy

It’s not just China in Trump’s crosshairs. The former president also rejected a proposed zero-for-zero tariff deal from the European Union, saying the EU would have to purchase $350 billion worth of U.S. energy exports—primarily natural gas and oil—before any tariff relief would be considered. The move suggests that Trump’s trade strategy may extend beyond Asia, affecting transatlantic alliances and global energy markets.

This marks a return to the hardline tactics that defined Trump’s first term, when trade wars with China, Canada, Mexico, and the EU led to widespread market disruptions, price hikes, and uncertainty for global investors.

Impact on American Households and Businesses

Economists warn that American consumers will bear much of the cost of the escalating tariffs. With tariffs effectively acting as taxes on imports, prices for everyday goods are expected to rise, especially in industries heavily reliant on Chinese manufacturing.

Retailers and manufacturers, already grappling with supply chain constraints, are bracing for margin squeezes. Many U.S. companies are now scrambling to diversify their supply chains to Southeast Asia, India, or Mexico—but such transitions are costly and take time.

At the same time, U.S. farmers and exporters could face new retaliatory measures from China, reminiscent of the 2018–2019 trade war, which severely hurt American agriculture.

Global Markets React

Markets responded nervously to the latest developments. The Dow Jones Industrial Average and S&P 500 both saw early dips in futures trading, while Asian markets closed in the red, reflecting the growing investor concern about prolonged uncertainty.

Some financial analysts have warned that if the tit-for-tat tariffs continue, a full-blown trade recession could loom on the horizon, with slowed global growth and weakened business investment.

What’s Next?

As both sides dig in their heels, hope for a diplomatic resolution seems dim—at least in the short term. China’s vow to “fight to the end” and Trump’s firm stance suggest a battle of endurance rather than compromise.

With an election year underway in the U.S., trade policy is again becoming a centerpiece of the political debate, further complicating any efforts to de-escalate. Investors, consumers, and businesses alike will be watching closely, as the consequences of this high-stakes standoff continue to unfold.

Conclusion

The intensifying U.S.-China trade conflict is more than just a clash of tariffs—it represents a broader ideological and economic rivalry that could reshape the global order. As tensions rise and retaliation escalates, the impact on everyday Americans, international relations, and global markets will likely grow more profound.

For now, the tariff storm shows no signs of easing, and the world is watching with bated breath.