The U.S. economy expanded at an annualized rate of 2.3% in the fourth quarter of 2024, reflecting steady economic resilience despite global uncertainties. This growth was primarily driven by consumer spending, which surged 4.2%—a sign that households remained confident in the economy despite inflationary pressures.

Inflation and Economic Stability

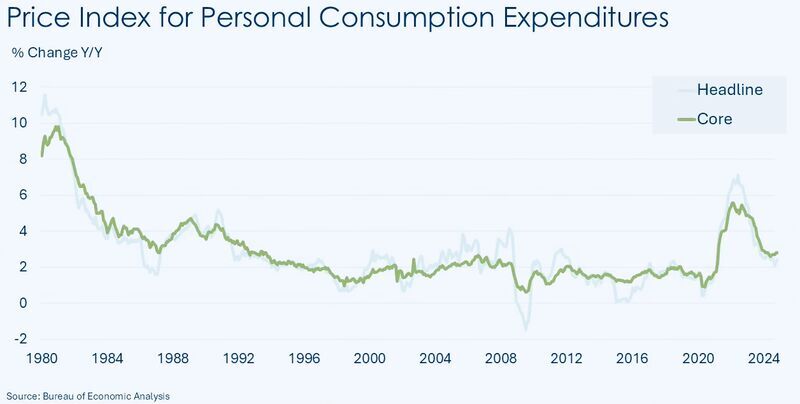

Core Personal Consumption Expenditures (PCE) inflation—the Federal Reserve’s preferred inflation gauge—was revised to 2.7%, slightly above policymakers’ 2% target. While this suggests inflationary pressures persist, it remains far below the peaks seen in 2022 and early 2023.

Spike in Unemployment Claims

Despite economic expansion, the labor market showed signs of softening as initial jobless claims jumped by 22,000 to 242,000, marking the largest weekly increase in five months. This spike suggests that some industries may be slowing down or adjusting their workforce levels in response to economic uncertainty.

On the other hand, continuing jobless claims—which track individuals still receiving benefits after an initial unemployment filing—declined by 5,000 to 1.862 million. However, the four-week moving average of claims increased by 8,500 to 224,000, signaling a potential cooling of the labor market.

What’s Next for the U.S. Economy?

With a combination of moderate growth, rising unemployment claims, and persistent inflation, the Federal Reserve will likely remain cautious in its approach to interest rate cuts in 2025. Analysts expect policymakers to closely monitor employment trends and inflation data before making any adjustments.

As the economy moves forward, all eyes will be on consumer spending patterns, labor market stability, and the Federal Reserve’s next steps in maintaining economic momentum while curbing inflation.

Sources: Reuters, Reuters[2], APNews, Bloomberg, CNBC, FoxBusiness, Equiti.