The U.S. housing market took a sharp downturn in January 2025, as housing starts fell 9.8%, marking a significant slowdown in construction activity. The annualized rate of 1.366 million units represents a concerning drop in homebuilding, driven by economic uncertainty, supply chain concerns, and potential new tariffs on key materials.

Declining Housing Starts Across the Board

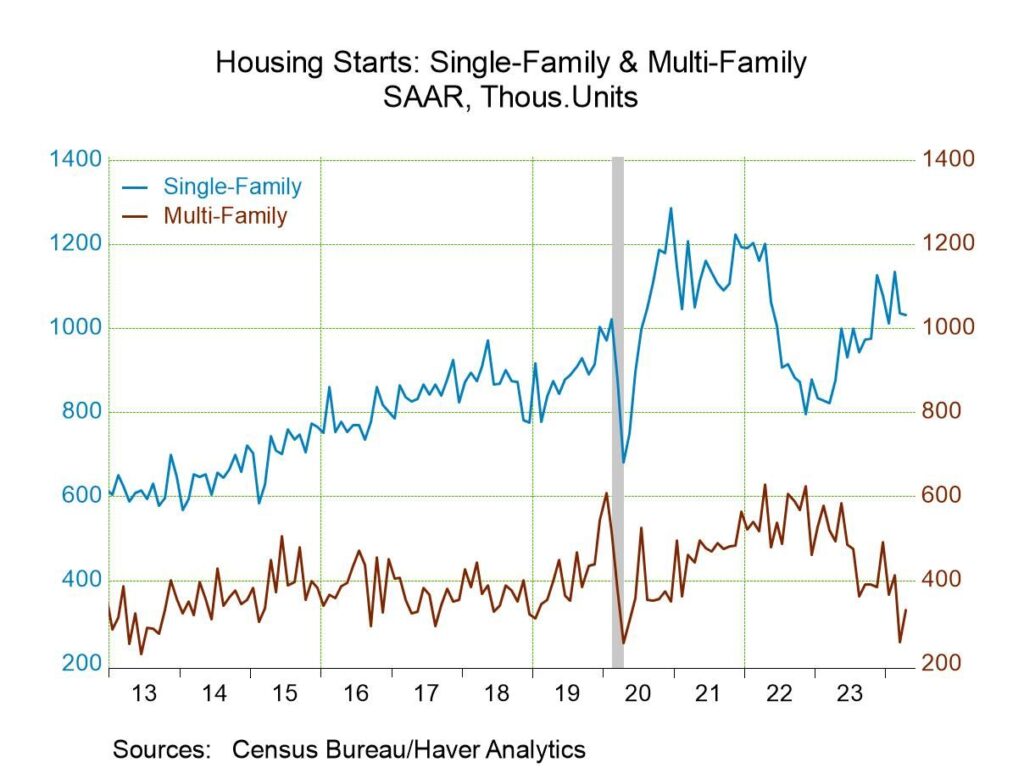

The slowdown affected both single-family and multifamily construction:

- Single-family home starts fell 8.4% to 993,000 units, showing a 1.8% decline year-over-year.

- Multifamily construction (which includes apartment buildings) suffered an 11.0% drop, with 355,000 units started.

These declines signal a cooling housing market, despite strong demand for homes.

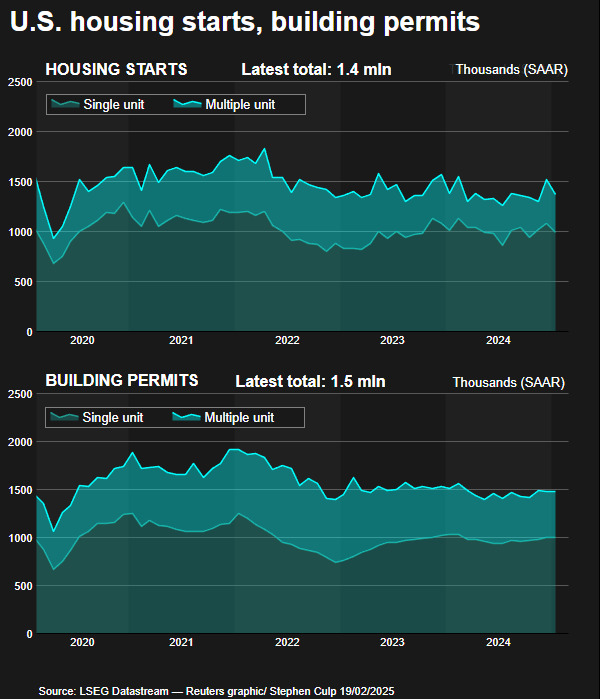

Building Permits Hold Steady, but Long-Term Concerns Grow

While building permits—a key indicator of future construction—rose 0.1% to 1.483 million units, single-family permits remained unchanged at 996,000, reflecting a 1.7% drop from last year. This suggests builders remain hesitant to ramp up projects, likely due to economic uncertainty and rising material costs.

Regional Disparities in Housing Growth

The impact of the slowdown varied across the country:

- Northeast: A staggering 27.6% decline in housing starts

- West: A 42.3% surge, showing a regional rebound despite broader declines

These regional shifts highlight how local market conditions, job growth, and demand are playing a major role in homebuilding trends.

Tariff Concerns and Market Confidence

The National Association of Home Builders/Wells Fargo Housing Market Index hit a five-month low, signaling waning builder confidence. A major concern is the looming threat of 10-25% tariffs on materials like lumber, which could drive up costs and further discourage new construction.

Looking Ahead

While housing demand remains strong, the drop in starts and stagnant permits suggest that affordability challenges, material shortages, and economic uncertainty could keep homebuilding sluggish in 2025. Unless supply constraints and cost pressures ease, the industry may continue to struggle to keep pace with demand.

Sources: Bloomberg, Reuters, AP, REN, NAHB, Realtor.