The U.S. inflation rate rose to 3% in January, marking an increase from December’s 2.9%, according to the latest Consumer Price Index (CPI) report. The monthly CPI increase of 0.5% represents the largest jump since August 2023, reflecting growing price pressures across several sectors. Core inflation, which excludes volatile food and energy prices, also edged up to 3.3% from 3.2% the previous month.

Key Drivers of Inflation

One of the most significant contributors to January’s inflation spike was the sharp rise in egg prices, which soared 15.2% from December to January. The increase was fueled by a bird flu outbreak that led to the culling of approximately 40 million birds, significantly reducing supply. Year-over-year, egg prices are now 53% higher than they were in January 2024.

Grocery prices also saw an uptick, with overall food inflation reaching 1.9%. While some staple items remained relatively stable, the cost of dairy products, fresh produce, and processed foods saw moderate increases.

Other Sectors Impacted

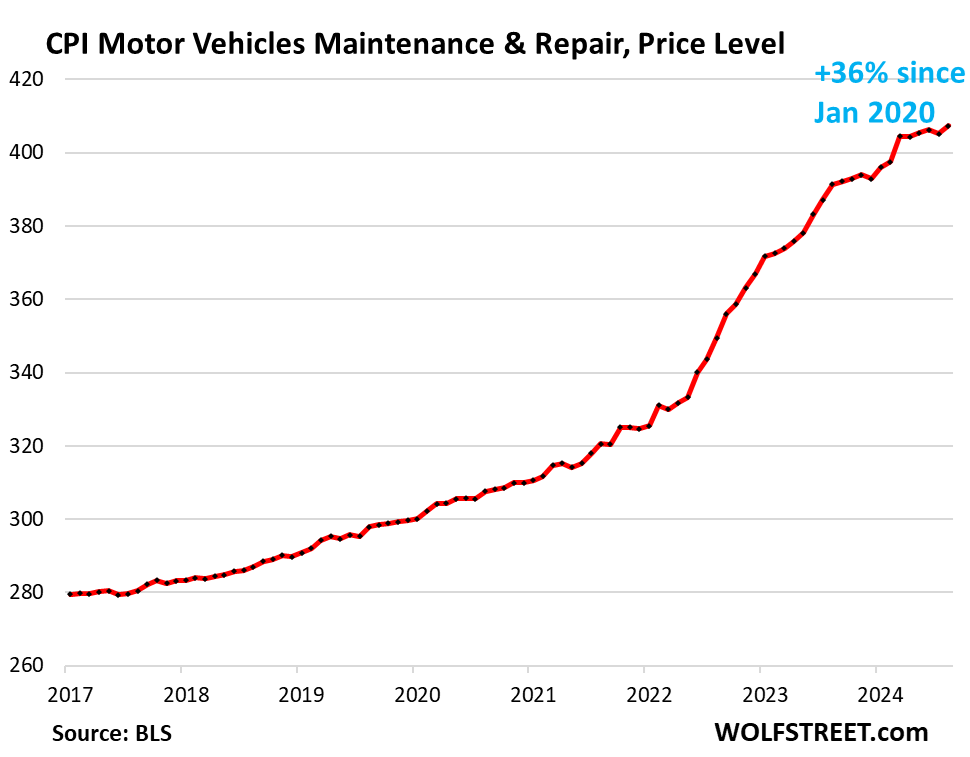

In addition to food prices, the inflation surge extended to other consumer essentials. Car insurance premiums rose by 2%, continuing a trend of rising costs in the auto sector. Hotel prices also climbed, with a 1.4% increase, reflecting stronger demand in the travel and hospitality industries.

Federal Reserve’s Response

The rise in inflation is expected to influence the Federal Reserve’s monetary policy decisions. With consumer prices climbing more than anticipated, the Fed is likely to maintain its current interest rate levels rather than proceed with any rate cuts. This decision could mean higher borrowing costs for consumers and businesses in the coming months, as the central bank prioritizes stabilizing inflation before easing monetary policy.

Economic Outlook

Despite inflationary pressures, the labor market remains resilient, and consumer spending has not shown significant signs of slowing. However, with persistently high costs in essential goods and services, household budgets may feel increasing strain in the months ahead.

Economists are closely monitoring upcoming inflation reports to assess whether January’s surge was a temporary spike or part of a broader trend that could shape economic policy decisions throughout 2025. For now, consumers should brace for continued price fluctuations as supply chain disruptions and demand-driven pressures influence the market.

Source: APnews