Wall Street posted strong gains Friday as investors cheered a better-than-expected U.S. jobs report, easing some concerns over the country’s economic resilience amid ongoing tariff tensions and inflationary pressures.

The S&P 500 climbed 1.3%, on track for its ninth consecutive day of gains, continuing its longest winning streak since late 2021. The Dow Jones Industrial Average jumped 449 points, or 1.1%, while the Nasdaq composite advanced 1.4%, buoyed by gains in technology and financial stocks.

Tech and Financial Stocks Lead Gains

Big tech stocks led the way, with Microsoft up 2.1% and Nvidia rising 2.6%. Investors have been leaning into large-cap tech companies amid expectations of continued earnings strength and innovation in AI and cloud computing.

However, Apple shares dropped 3.3% after the company revealed it could face $900 million in additional costs due to U.S. tariffs, especially from ongoing trade frictions with China. The company’s warning underlined broader concerns among multinationals grappling with shifting global trade policies.

Banks and other financial institutions also rallied, with JPMorgan Chase rising 2.1% and Visa up 1.6%, on renewed confidence in consumer spending and solid job growth.

April Jobs Report: Better Than Expected

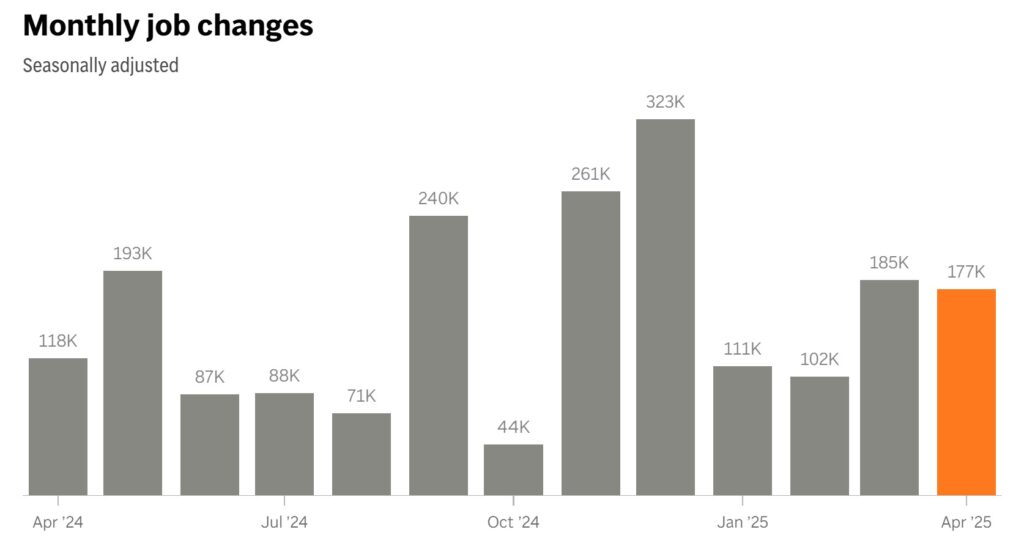

The Labor Department reported that 177,000 jobs were added in April, a modest slowdown from March but still stronger than the 150,000 economists had forecast. The solid hiring data helped ease fears of a significant economic cooldown, especially amid tighter credit conditions and geopolitical uncertainties.

However, economists noted that the effects of President Trump’s latest tariffs were not yet reflected in these figures. Many of the tariffs originally scheduled to take effect in April have been delayed by 90 days, except those on Chinese goods, which remain in force.

Tariff Tensions Cloud Outlook

“Unless the administration changes direction when the pause ends in July, we’ll likely see another period of volatility similar to what we saw in early April,” warned Chris Zaccarelli, chief investment officer at Northlight Asset Management.

Earlier this month, markets were rattled when the S&P 500 dropped 9.1% in one week after Trump’s announcement of sweeping new tariffs. While some of that ground has since been regained thanks to strong earnings and hopes for de-escalation with China, uncertainty remains high.

The first quarter of 2025 saw a 0.3% annual contraction in U.S. GDP, largely driven by a surge in imports as businesses tried to get ahead of tariff implementation. The ripple effects are showing in weakened business confidence, supply chain adjustments, and lower forward guidance.

Corporate Earnings Paint a Mixed Picture

While Friday was quieter for earnings, Exxon Mobil and Chevron both reported their lowest first-quarter profits in years, dragged down by falling crude oil prices. U.S. crude oil has dipped 18% this year, falling below $60 a barrel—below the breakeven point for many producers.

Meanwhile, Block Inc., the parent company of Cash App, tumbled 21.9% after posting a steep decline in Q1 profit, citing reduced consumer discretionary spending, especially in travel and entertainment.

Treasury Yields Rise

The bond market saw yields increase on the back of the strong jobs data. The 10-year Treasury yield rose to 4.30% from 4.22% late Thursday, indicating growing investor expectations for continued economic momentum and possibly fewer rate cuts than previously expected.

Looking Ahead

While the job market’s resilience has offered Wall Street a shot of optimism, investors remain cautious as they await July’s decision on the paused tariffs. With inflation still sticky and geopolitical risks evolving, markets are likely to remain sensitive to new developments in trade and fiscal policy.

Bottom Line: Wall Street’s rally reflects confidence in the U.S. job market and corporate earnings—but looming tariffs and global uncertainty mean that this momentum could be tested in the months ahead.