China’s real estate sector, long a pillar of the nation’s economic growth, is facing unprecedented challenges. The latest and most striking development comes from China Vanke, one of the country’s leading property developers, which has announced a staggering loss of 45 billion yuan (approximately $6.2 billion) for 2024. This marks the company’s first annual loss since its founding in 1991, signaling a deepening crisis in an already faltering market.

Leadership Shake-Up Amid Financial Crisis

In response to the financial debacle, both Chairman Yu Liang and CEO Zhu Jiusheng have tendered their resignations. This leadership upheaval underscores the severity of Vanke’s troubles. To stabilize the company and steer it through turbulent waters, Xin Jie, chairman of Vanke’s major shareholder Shenzhen Metro, has been appointed as the new chairman.

The leadership transition comes at a critical time when investor confidence is waning, and stakeholders are seeking reassurance about the company’s future direction.

Vanke’s sales performance has been a major contributor to its financial woes. The company reported a 35% decline in sales for 2024, amounting to about 51.3 billion yuan. This sharp drop follows a relatively healthy profit of 12 billion yuan in 2023. The figures reflect broader struggles within China’s real estate market, where home sales have fallen by 18% industry-wide.

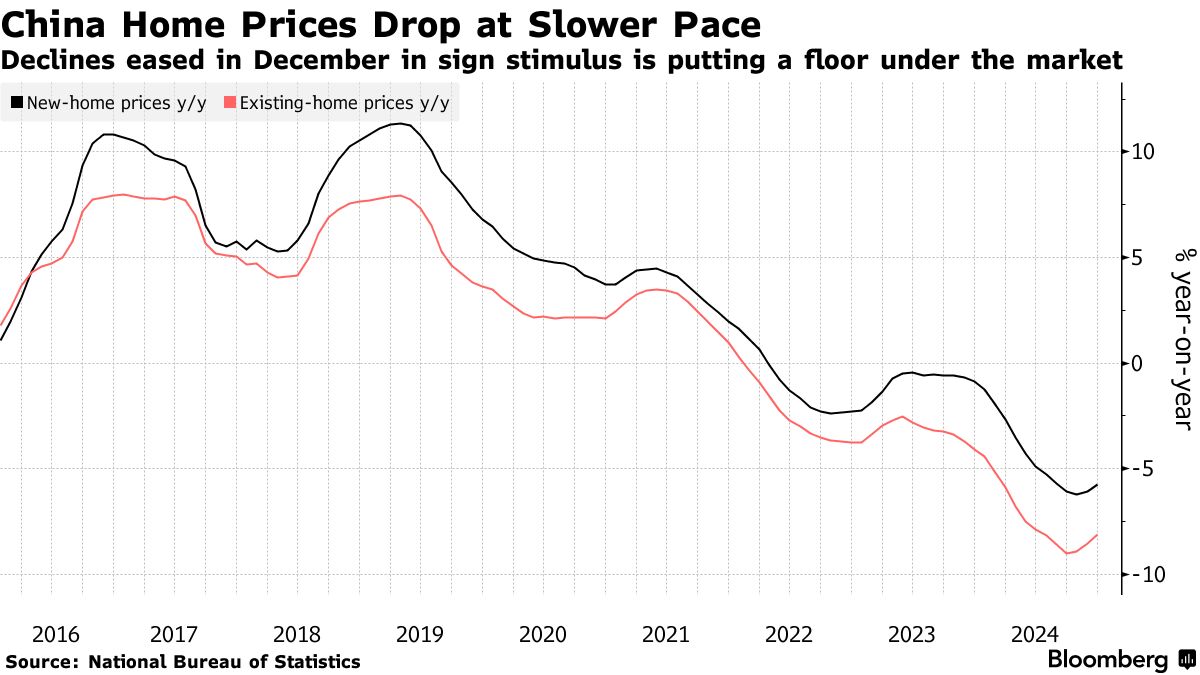

The downturn has been fueled by a combination of factors, including tightened government regulations, declining demand, and a sluggish economy. The once-booming property market, which played a crucial role in China’s rapid urbanization, now faces oversupply and mounting debt issues.

Vanke’s financial stability is further threatened by its looming debt obligations. The company faces onshore debts totaling 32.64 billion yuan maturing in 2025. Given the current financial strain, there are growing concerns about Vanke’s ability to meet these obligations without resorting to asset sales or other drastic measures.

Analysts warn that the company’s debt crisis could have ripple effects across the industry, potentially triggering defaults among smaller developers and exacerbating the sector’s downturn.

Broader Implications for the Real Estate Sector

The challenges facing Vanke are symptomatic of a wider malaise afflicting China’s real estate industry. Once a symbol of economic dynamism, the sector is now grappling with declining consumer confidence, restrictive government policies, and a tightening credit environment. The collapse of major players like Evergrande and the struggles of Country Garden have already sent shockwaves through the market.

The decline in home sales and property investments has also weighed heavily on China’s GDP growth, with real estate accounting for a significant portion of the economy. Experts fear that continued instability in the sector could further drag down economic performance.

In the wake of the real estate crisis, Chinese authorities have introduced measures aimed at stabilizing the market, including easing restrictions on home purchases and offering financial support to struggling developers. However, it remains to be seen whether these interventions will be sufficient to revive the sector and restore investor confidence.

For Vanke, the path forward will likely involve a combination of debt restructuring, strategic asset sales, and operational reforms under Xin Jie’s leadership. The company’s ability to navigate these challenges will be a litmus test for the broader resilience of China’s real estate sector.

As the crisis unfolds, stakeholders will be closely watching Vanke’s next moves. The company’s survival and recovery will depend on its ability to adapt to the new market realities and manage its debt obligations effectively.

The turbulence in China’s real estate market serves as a stark reminder of the risks inherent in an industry that has long been a cornerstone of the nation’s economic strategy. How China and its leading developers respond to this crisis will shape the future trajectory of the sector and the broader economy.