Ari Baum, CFP®

DO ANY OF THESE THOUGHTS SOUND FAMILIAR?

• “I SHOULD HAVE BOUGHT THAT STOCK BEFORE IT WENT PUBLIC!”

• “I WISH I HAD INVESTED IN THAT TECH COMPANY BEFORE IT TOOK OFF!”

• “WHAT’S THE NEXT ‘UNICORN’ THAT’LL MAKE ME RICH?”

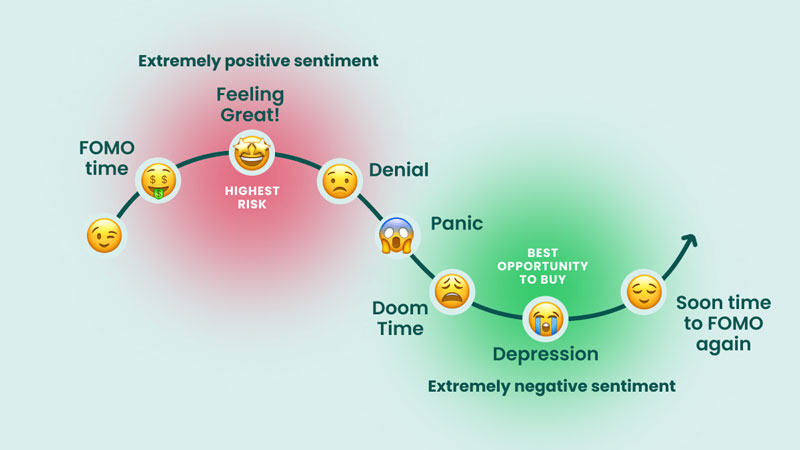

If so, you’re not alone. Many of us experience the “fear of missing out” (FOMO) in our financial lives. It’s that nagging feeling that we’ve missed a golden opportunity, driving us to make hasty decisions that could derail our long-term financial goals.

Understanding the FOMO Trap

Investing FOMO is closely tied to two powerful psychological forces: herd mentality and a scarcity mindset.

Herd mentality: We assume popular ideas are “good” because everyone else is on board. This can lead us to skip our due diligence and ignore contrary evidence.

Scarcity mindset: We overvalue opportunities simply because they seem rare or time-sensitive, often overestimating their potential based solely on their exclusivity.

When FOMO takes over, we’re more likely to:

• Make impulsive decisions based on incomplete information.

• Chase trends, buying high and selling low.

• Take on more risk than we normally would.

• Focus on success stories, ignoring the risks and failures.

These behaviors can set us up for significant losses, heightened anxiety, and even strain our relationships.

One recent example? The cryptocurrency boom of 2021-2022. Investors flocked to coins like Dogecoin, spurred by celebrity endorsements and fear of missing out. The result was a rollercoaster ride of wild gains and steep losses, with many left holding the bag when the hype fizzled.

The Power of Patient Investing

FOMO can be overwhelming, but it doesn’t have to dictate your financial choices. The antidote? Patient investing—building wealth steadily over time with a strategy focused on long-term growth.

Patient investing involves:

• Diversification: Spreading investments across different asset classes to manage risk.

• Index fund investing: Gaining broad market exposure with funds that track indices like the S&P 500.

• Compound interest: Harnessing the power of interest on interest to accelerate growth over time.

Warren Buffett is a prime example of the power of patience. At 21, he was worth just $20,000. He didn’t earn 99% of his wealth until after 50 and became a billionaire at 56. Buffett’s story underscores the value of playing the long game and resisting the siren call of FOMO.

How to Build a FOMO-Resistant

Investment Strategy: 7 Tips

1. Create a solid plan: Base your investment decisions on your long-term goals, risk tolerance, and time horizon.

2. Diversify: Don’t put all your eggs in one basket. Spread your investments to balance risk.

3. Automate your contributions: Set up automatic investments to stay consistent and remove emotion from the equation.

4. Stay focused on the long term: Remember that market volatility is normal. Don’t let short-term fluctuations derail your strategy.

5. Educate yourself: The more you know about investing, the easier it is to tune out FOMO.

6. Limit portfolio checks: Constant monitoring can lead to overreactions. Check in periodically but avoid obsessing over every dip and spike.

7. Take a cool-off period: Before jumping into any new investment, wait 24 hours, do your homework, and seek advice from a trusted source.

Goodbye FOMO, Hello Strategy

FOMO is a natural feeling, but it doesn’t have to control your financial decisions. By staying focused on your long-term goals and maintaining a patient approach, you can avoid the traps of FOMO and build a resilient, growth-oriented portfolio. When in doubt, consult with a financial professional who can provide guidance grounded in experience, not hype.

The content is developed from sources believed to be providing accurate information. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. Consult with a financial professional regarding your specific situation.

Ari Baum, CFP® is the founder and CEO of Endurance Wealth Partners, with over 25 years of experience in the Financial Services industry. He brings his in-depth experience to Conceive. Believe. Achieve. for his clients.

Securities and Advisory services offered through Prospera Financial Services Inc. Member FINRA/SIPC. Brokerage and Advisory accounts carried by Wells Fargo Clearing Services, LLC.