Imagine: you spent more than 10 years saving for the down payment on a new home only to see it all disappear in an instant. This may seem unrealistic, but it’s happening as hackers target home buyers and their down payments.

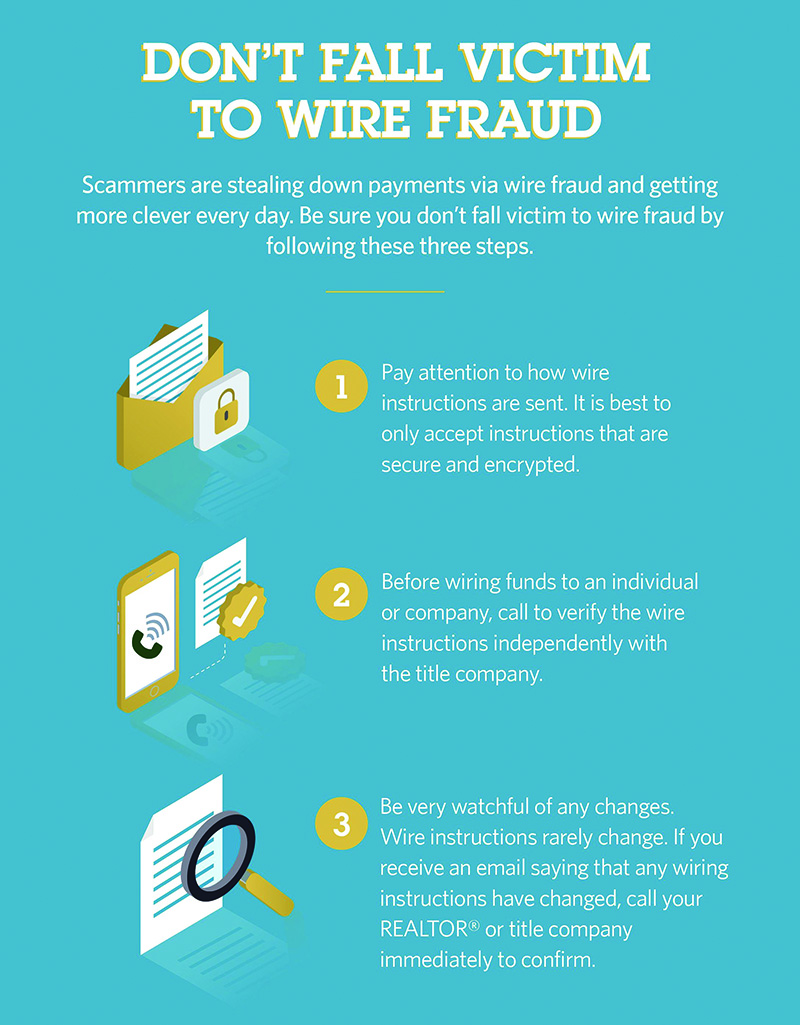

FBI data shows a rise in wire fraud in the real estate industry. Title companies, attorneys, and real estate brokers have all been targeted through phishing email scams that allow hackers to use malware to monitor emails.

The hacker attempts to steal the down payment money by monitoring emails between the bank and the buyer about wiring money. Then he/she sends an email, posing as the bank and requesting that the down payment be wired to a specific account, which is then directed into an offshore account or multiple accounts making it very hard to trace.

This is just one of the many scams that home buyers fall for, and when they do, it’s so sad. They go from ready to buy a home to wondering how everything fell apart.

Protect Yourself from Potential Scams

The home buying process is already stressful enough, you shouldn’t have to worry about becoming the victim of a scammer at the same time. Here are a few things you can do to protect yourself.

Hire Experienced, Professional Help

Make sure you hire an experienced real estate agent to help guide you through the process. The right agent will not only save you time and money, but he/she will also know how to spot one of the many scams from a mile away and steer you clear.

Use a Reputable Lender

Some scams target you through a shady, dishonest lender. Make sure you choose a reputable lender with plenty of experience. Ethical lenders will never ask you to pay money up front or offer you an interest rate before they’ve checked your credit.

Always Purchase Title Insurance

While title fraud isn’t the most common real estate scam, it’s still something to be aware of. It’s when a scammer steals your identity and forges documents to either re-mortgage your home and walk away with the cash, or to sell your home right out from under you. Any reputable lender will require you to purchase title insurance, which protects against this situation.

Recognize What’s Too Good To Be True

If a deal on a home, a mortgage, or anything else having to do with purchasing a home seems too good to be true, it probably is. Don’t fall for phone calls or emails offering low, low mortgage rates. If you receive an offer for an excellent deal, show it to your real estate agent before you accept. If it’s too good to be true—it’s probably a scam.

Common Real Estate Scams Listing Scams

One of the most common ways scammers try to get your money is through a listing scam. First the scammer finds a home for sale online, then re-posts it with his contact information. When a potential buyer calls, he tries to charge an application fee. If the buyer pays it, the scammer then disappears never to be heard from again.

You can easily avoid listing scams by working with a reputable real estate agent. If you’re looking for a home without an agent, make sure all listings have business information and credentials of a real estate agent representing the home.

Unlicensed Realtor Scam

This scam includes an unlicensed realtor doing everything a regular realtor would do, but when the check is written for escrow, they deposit it into their own account.

So, always make sure your realtor is properly licensed and has a solid reputation.

Avoiding scams when buying a home requires your diligence. Develop relationships with everybody you will be working with throughout the process. Solid relationships with those handling your money and the purchase of a home, will ensure you don’t get sucked into a scam that could cost you thousands of dollars.

Author Mekanie Kishk